Employee exits are a routine aspect of business operations. Whether it's due to resignation, retirement, or termination, it’s crucial to handle all financial settlements accurately. This is where payroll management services play a key role, ensuring everything is processed clearly and correctly. This is known as the exit payroll or the Full and Final (FnF) Settlement process.

If this step is not managed properly, it can lead to legal trouble, unhappy ex-employees, and even loss of trust among existing staff. This guide explains everything Indian companies need to know about exit payroll, along with how a reliable payroll partner like Paysquare can make this easier.

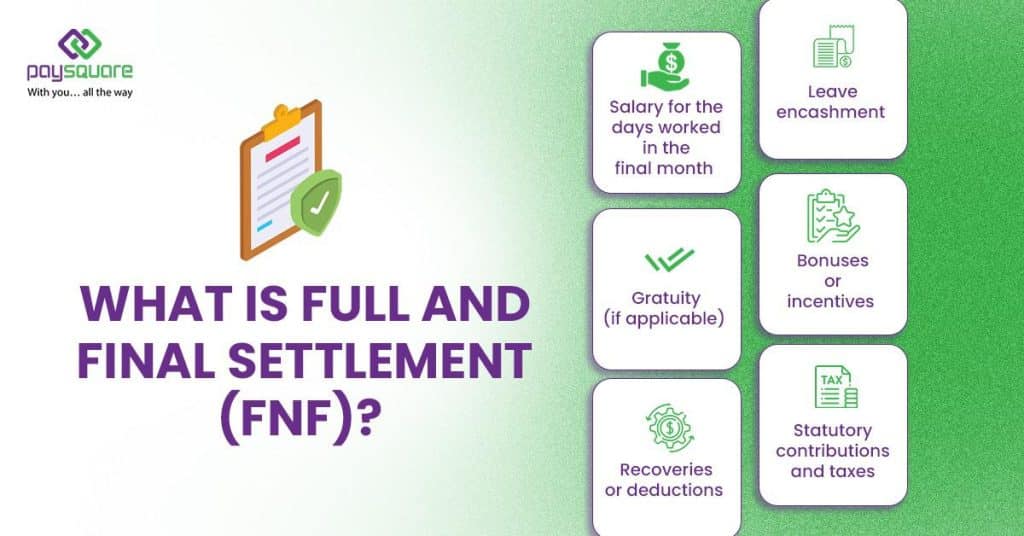

What Is Full and Final Settlement (FnF)?

FnF Settlement is the final payment made to an employee when they leave the company. It includes:

- Salary for the days worked in the final month

- Leave encashment

- Gratuity (if applicable)

- Bonuses or incentives

- Recoveries or deductions

- Statutory contributions and taxes

The goal of payroll management services is to ensure that employees receive their rightful dues while employers meet all necessary formalities promptly and by Indian labour laws.

Components of Exit Payroll in India

Here is a breakdown of what usually goes into calculating FNF settlements:

1. Salary for Last Working Days

Calculate the salary based on the actual number of days the employee worked in their final month. If payroll is monthly, divide the gross or basic salary by 30 (or as per company policy) and multiply by the number of days worked.

2. Leave Encashment

If the employee has any unused paid leave, they must be paid out. The rate is usually based on basic salary. Check your state’s Shops and Establishments Act or company policy.

Example:

If the employee has 10 days of leave balance and a basic salary of ₹30,000:

Encashment = (30,000 / 30) × 10 = ₹10,000

3. Bonus or Incentive Payouts

Any due bonuses, performance incentives, or commission payments should be added, even if the payout cycle has not yet arrived.

4. Gratuity

Employees who complete five years of continuous service are eligible under the Payment of Gratuity Act, 1972.

Formula:

Gratuity = (Last drawn basic salary × 15 × No. of years of service) ÷ 26

Example:

Basic salary = ₹25,000, service = 6 years

Gratuity = (25,000 × 15 × 6) / 26 = ₹86,538.46

5. Deductions

Deductions may include:

- Unpaid loans or advances

- Notice period recovery (if the employee did not serve the Full notice)

- Damage to property or missing company assets

- TDS (Tax Deducted at Source) based on income tax slabs

6. Statutory Contributions

Ensure deductions and filings for:

- EPF (Employee Provident Fund)

- ESIC (Employee State Insurance)

- Professional Tax (PT)

- Labour Welfare Fund (if applicable)

All filings must be updated on their respective portals.

Steps to Process Exit Payroll

Follow these steps to carry out a proper and timely FNF Settlement:

Step 1: Acknowledge Resignation/Exit

Formally acknowledge the exit as soon as the employee submits their resignation or is asked to leave. Once you confirm their last working day, start the FnF process immediately.

Step 2: Coordinate with All Departments

The HR team should check with:

- IT for the return of the laptop, mobile, or software deactivation

- Finance/Admin for reimbursements or company advances

- Team Leads for handover status and leave records

Step 3: Reconcile Leave and Attendance

Calculate the number of working days and check for any unused paid leaves. Update this in the payroll system.

Step 4: Final Settlement Calculation

Use payroll software or spreadsheets to calculate:

- Days worked

- Leave encashment

- Any bonuses due

- Deductions

- Statutory dues

Step 5: Seek Internal Approval

Share the calculated statement with relevant teams—HR, finance, and department heads—for final approval.

Step 6: Make the Payment

Once approved, the final amount should be transferred to the employee’s bank account. This can be processed in the regular payroll cycle or as an off-cycle payment.

Step 7: Share Documents

Provide the employee with:

- Final payslip

- FnF breakup report

- Form 16 (at year-end)

- Experience letter

- Relieving letter

- Gratuity and PF withdrawal forms (if needed)

Legal and Statutory Rules for Exit Payroll in India

- Notice Period Recovery: If the employee leaves early, recover the shortfall as per the employment contract.

- Gratuity: Mandatory after 5 years of service unless terminated for misconduct.

- TDS: Deduct TDS as per the employee’s salary bracket.

- Timelines: As a best practice, employers should make full and final payment within 45 days of the employee's last working day (some states require faster timelines).

- Form 16: Must be issued by May 31st of the next financial year.

Common Mistakes to Avoid

- Delaying Payments

Late FnF can lead to legal action under the Payment of Wages Act. - Wrong Leave Balance

Many firms forget to update the leave records correctly. - Ignoring Recoveries

Failing to recover dues (like loans or advances) can cause financial loss. - Manual Errors in Calculation

Always double-check figures. Using payroll software can help. - Not Filing Exit in EPFO/ESIC

Forgetting to mark exit dates in official portals can delay PF withdrawals.

Why Companies Struggle with Exit Payroll

- Too many departments are involved

- Inconsistent documentation

- Lack of automation

- Unclear policies

- Heavy dependency on HR staff

This is where a payroll outsourcing partner can make a big difference.

How Paysquare Helps with Exit Payroll

With over two decades of expertise, Paysquare offers reliable Payroll Outsourcing Solutions in India, managing everything from regular payroll processing to exit settlements for businesses of all sizes.

Here’s how Paysquare simplifies FnF settlements:

- Automated Calculations

No manual errors. Accurate salary, bonus, leave, and tax calculations. - Centralised Payroll System

Leave records, attendance, and salary data are all connected. - Document Generation

FnF reports Form 16 and relieving letters are generated automatically. - Compliance Handling

Timely filings for TDS, EPF, and ESIC. All updated with correct exit data. - Data Security

Secure cloud-based system protects sensitive employee information. - Expert Support

A dedicated team that answers all your queries on time.

With over 25 years of experience and a strong client base of 3,000+, Paysquare delivers reliable payroll management services—free from delays, errors, or penalties—when it matters most.

When to Consider Outsourcing Your Exit Payroll

Consider outsourcing if:

- You face delays or errors in FnF payments

- Your internal HR team is overworked

- You are struggling to stay compliant with tax or labour laws

- Employee complaints about offboarding are increasing

- Your business is growing, and processes need to scale

Outsourcing frees up your HR team to focus on employee engagement while the experts handle compliance and calculations.

Conclusion

Exit payroll is not just an HR formality. It’s a legal and financial process that, if mishandled, can harm your company’s image and lead to penalties. A smooth exit experience builds trust, even with former employees.

If your business is looking for support with payroll and full-and-final settlements, Paysquare provides reliable, accurate, and compliant payroll management services to meet your needs.