One of the most pivotal functions that any business performs is paying its workers. This implies that, if heaven forbid, there are hitches in the most timely and accurate payment of the workforce, trust may be in jeopardy, as well as morale and regulatory compliance that stem from it. Mistakes or delays in costs caused by inadequate Payroll Tracking Software can result in operational dissatisfaction, compliance fines, and increased administrative inefficiencies.

DeliziaHR’s precision-driven Payroll Outsourcing Solutions deliver advanced payroll parameters and comprehensive reporting capabilities, ensuring accurate calculations and timely payroll processing.

Understanding Payroll Tracking

A payroll tracking software meticulously manages all aspects of employee payments, from master data recording to absences, tax sweeps, PF/ESI/TDS deductions, reimbursements, net pay, payslip generation, and statutory filings.

Key components include the following:

- Exact employee details (bank details, tax IDs, salary structure)

- Time and attendance records, leave tracking, and overtime

- Deductions like PF, ESI, taxes, and voluntary contributions

- Reimbursements, bonuses, and allowances

- An audit trail to track transactions and query resolutions

- Integration with other relevant HRMS and accounting systems

Effective tracking ensures that teams conduct each payroll cycle meticulously, accurately, on time, and in full compliance with statutory norms.

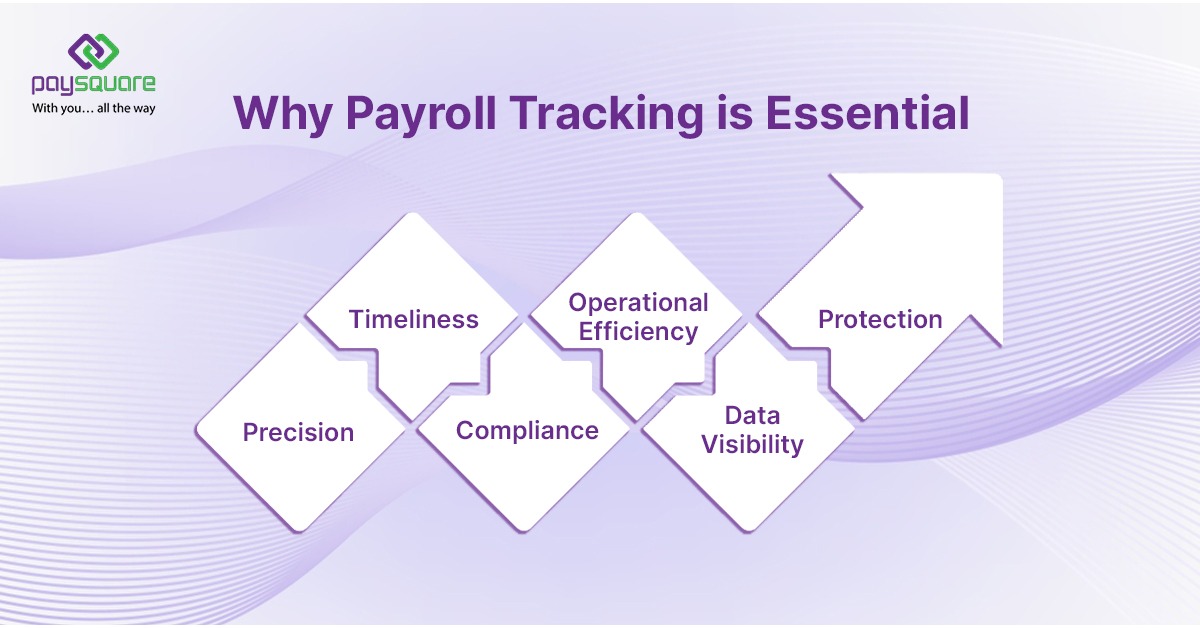

Why Payroll Tracking is Essential

All organisations—regardless of size or industry—can gain measurable advantages by implementing Payroll Tracking Software.

- Precision: Wage computation errors and deductions are reduced with the automated process.

- Timeliness: Streamlining steps will ensure that staff get paid as expected.

- Compliance: Payroll tracking guarantees compliance with existing labour laws, tax regulations, and statutory filings.

- Operational Efficiency: Automating manual work enables HR teams to manage their strategic labour more efficiently.

- Data Visibility: Dashboards for centralised reporting provide analyses of payroll trends, costs, and compliance.

- Protection: Securing such data is simplified through secure access, encryption, and auditing.

Under the DeliziaHR banner, advanced tracking capabilities make these benefits a reality across all sizes of organisations.

How DeliziaHR Supports Advanced Payroll Tracking

With DeliziaHR, HRMS, time and attendance, leave, payroll, reimbursements, compliance, and exit management applications are integrated into a single platform. For advanced payroll tracking, DeliziaHR provides the following capabilities:

1. One Centralised Source and Data Integrity Management

DeliziaHR centralizes essential employee data and verifies it as needed, ensuring payroll calculations are accurate and based on reliable information.

2. Attendance, Leave, and Time Capture

Accurate payroll starts with precise time and attendance data. DeliziaHR captures this via mobile apps, geolocation, biometrics, and dashboards, while leave requests are automatically approved hierarchically and integrated into payroll for exact deductions or payouts.

3. Automated Payroll Engine

The DeliziaHR Payroll Engine calculates salaries, bonuses, incentives, and deductions per laws and company policies, automatically generates payslips, and logs all inputs, adjustments, and approvals—minimizing errors through robust privacy and audit controls.

4. Query & Exceptions

Employees can raise necessary payroll-related queries. The payroll team identifies, clarifies, and addresses any unacceptable payroll exceptions, maintaining employee trust and avoiding payment delays

5. Security & Workflow of Approval

DeliziaHR provides layered logins for employers and employees with simultaneous admin access, two-factor authentication, and single sign-on. It manages approval workflows for salaries, reimbursements, and offboarding, securely tracks all transactions, and ensures data integrity.

6. Monitoring and Reporting

DeliziaHR offers payroll tracking benefits with dashboards and reports that monitor accuracy, cycle times, deductions, and anomalies, helping HR and finance teams resolve issues and boost payroll efficiency.

Benefits of Using DeliziaHR’s Payroll Tracking

There are several advantages to implementing DeliziaHR as a reliable Payroll Tracking Software.

- Reduced Errors: Automated calculations and validated inputs minimise mistakes.

- Timely Payments: Streamlined workflows ensure salaries are processed on time.

- Employee Trust: Reliable payments and resolved queries encourage morale and engagement.

- Compliance: Built-in tracking guarantees compliance with labour laws and tax regulations.

- Operational Efficiency: Automation reduces operating overhead and costs.

- Actionable Insights: Detailed reports and dashboards provide strategic visibility for decision-making.

Best Practices for Effective Payroll Tracking with DeliziaHR

It is crucial to consistently adhere to these best payroll practices to enable accurate validation and maximise the value delivered by DeliziaHR’s payroll services and Payroll Tracking Software.

Step 1: Ensure Accurate Master Data

The company’s management needs to obtain accurate information from employees regarding bank accounts, applicable tax laws, and the salary structure for payroll administration. This information is stored and audited within the module by the program.

Step 2: Integration with Leave Management Tools

Link the leave and attendance modules to payroll processing during implementation. This links the actual number of working hours and leave sanctions to the payroll.

Step 3: Defining the Approval Workflows

Implement hierarchical approval protocols for expending salary changes, refunds, offboarding, etc., then monitor the audit trail.

Step 4: Pre-Process Payroll Audit

Check the methods for identifying staff payroll issues before the final payroll run and use templates to review the anomalies at a glance, like missing attendance feedback, unapproved off days, changes to pay, and so all, which are subject to error sources.

Step 5: Payroll Processing Monitoring

Run payroll through DeliziaHR’s automated engine and monitor pay runs, deductions, and pay slip delivery. Keep track of any post-run deductions and fix them on an ongoing basis.

Step 6: Review and Improve

Analyse such data about payroll reports as error rates, query volumes, and examples of process bottlenecks for every organisation; refine workflows, train actively, and optimise the payroll process at the same time.

What DeliziaHR Must Have for Every Organisation.

In the way that DeliziaHR not only shows payroll reports but can also track payroll processes effectively, DeliziaHR works wonders for businesses of all sizes:

- For Small and Medium Companies: Refines the complex task of payroll automation because of its compliance and reduction of administrative work.

- For Large Enterprises: It can control multiple locations, large numbers of employees, complex pay structures, and multicountry payroll threats.

- For Growing Organisations: Capability to grow with the business. New staff and new sites can be added to the system and adapt to new pay rules without disruption.

DeliziaHR integrates tracking across the entire payroll workflow, ensuring error-free processing and on-time payments every time.

Conclusion

Payrolls form the lifeline of every business organisation, where managing continuous calculations, varying pay periods, and strict payment schedules is critical to ensuring accuracy and timeliness. Payroll Tracking Software from DeliziaHR streamlines this entire process by operating on a single, powerful payroll engine integrated with HRMS, attendance, leave management, payroll, claims, expenses, and compliance modules.

This advanced, automated payroll engine handles employee eligibility, diverse salary components, and fully customised payroll settings with ease. Payroll Tracking Software efficiently addresses employee queries, reduces paperwork, and eases the administrative burden on HR and finance teams while improving overall payroll accuracy and efficiency.

A slight level of complexity may be beneficial because, first, the aforementioned features offer opportunities for development while maintaining a state of readiness for evolving business models and upcoming laws. Secondly, they reduce confusion, prevent employer-employee disputes, streamline government correspondence, and improve employee reimbursements.