Partnering with a reliable payroll management company can simplify complex payroll tasks for organisations, even those operating across multiple countries. By leveraging expert knowledge in local laws, currencies, and cultural practices, businesses can ensure timely and accurate salary disbursements, building employee trust and avoiding costly errors.

Key Challenges in Managing Payroll Across Different Countries

1. Understanding Different Legal and Compliance Requirements

A reliable payroll management company can help businesses streamline their payroll processes, ensuring timely salary disbursements and accurate record-keeping across multiple regions.

For example, in India, employers must deduct Provident Fund (PF) and Professional Tax, while in Singapore, contributions are made to the Central Provident Fund (CPF). Similarly, in European countries, businesses must comply with strict data and payroll regulations like GDPR.

Keeping up with all these changes can be overwhelming, especially when governments frequently update labour laws and tax structures. Failing to comply can result in fines, penalties, or even legal action. Businesses need strong systems and local expertise to stay compliant across borders.

2. Managing Multiple Currencies and Exchange Rates

When operating globally, companies pay employees in different currencies. Managing currency conversions, exchange rate fluctuations, and transaction costs can be complicated.

A small change in currency value can significantly impact overall payroll expenses. For instance, paying employees in countries with volatile exchange rates may cause budgeting problems. Moreover, international bank transfers may involve high transaction fees and delays.

To manage this effectively, companies often rely on multi-currency payroll systems that automatically convert payments using real-time exchange rates. This ensures accuracy and transparency for both employers and employees.

3. Ensuring Data Security and Privacy

Payroll involves highly sensitive information, employee names, identification numbers, bank details, and salary data. When this data moves across multiple countries, security risks increase.

Different countries also have unique data protection laws. For example, under GDPR in the European Union, employee data cannot be stored or processed outside the EU without proper safeguards. Similarly, other nations like China and Brazil have introduced their own data privacy regulations.

Partnering with a reliable payroll management company can help businesses streamline salary processing, improve efficiency, and reduce administrative burden, even though it may not fully protect against regulatory penalties or reputational risks.

4. Coordinating with Multiple Payroll Providers

Many companies rely on local payroll vendors to handle country-specific requirements. While this helps with compliance, managing several vendors can be confusing. Each provider might use a different system, report format, or pay cycle, leading to inconsistency and a lack of control.

For instance, one vendor may process payroll monthly, another biweekly. Some might follow different methods for expense reimbursements or bonuses. As a result, central HR teams struggle to consolidate data for global reporting.

To overcome this, businesses often move to centralised global payroll platforms or partner with a single provider offering multi-country services. This ensures standardisation, better visibility, and easier management.

5. Handling Time Zones, Languages, and Communication Barriers

Global teams work across different time zones and languages, which can cause delays in communication and approvals. Payroll is time-sensitive — delays in one region can affect the entire cycle.

Language barriers also create issues when interpreting laws, contracts, and payslips. Employees may not understand local tax terms or deductions clearly, leading to confusion and frustration.

Companies must ensure that documentation and payslips are available in local languages and that their payroll teams or providers offer multilingual support. Clear communication channels help avoid misunderstandings and ensure employees are paid correctly.

6. Cultural Differences in Pay and Benefits

Compensation practices differ widely across countries. For instance, in Japan, employees may receive bonuses twice a year, while in the U.S., bonuses are usually performance-based. In European countries, companies often offer more paid leave and social benefits than in other regions.

If a company applies the same payroll policy globally, it can lead to employee dissatisfaction or non-compliance. Understanding and respecting cultural expectations regarding pay frequency, holidays, and benefits is essential.

Global payroll systems should therefore be flexible, allowing for local customisation while maintaining global consistency in data and reporting.

7. Compliance with Tax and Social Security Contributions

Each country has different tax structures and social contribution systems. For example:

- United States – Employers must handle federal, state, and local taxes.

- United Kingdom – Companies contribute to National Insurance.

- India – Employers must manage TDS, PF, and ESI deductions

Missing or incorrectly calculating any of these can lead to fines or audits. It becomes even more complex when employees work in multiple jurisdictions, such as remote workers or expatriates.

Automated payroll services help by calculating and filing taxes correctly, ensuring real-time compliance across regions.

8. Integration with HR and Accounting Systems

Payroll is closely linked to other functions like HR, accounting, and finance. When these systems don’t communicate effectively, it leads to data duplication and errors.

For instance, if employee attendance or leave data isn’t updated in the payroll system, it may result in incorrect salary payments. Similarly, expense reimbursements or bonuses might be missed if accounting systems are not integrated.

Modern cloud-based payroll platforms solve this issue by connecting HR, finance, and payroll modules in real time. This ensures accuracy and saves valuable time for HR teams.

9. Hidden Costs and Administrative Burden

Running payroll across countries involves many hidden costs, local compliance fees, software licensing, exchange rate differences, and consulting expenses. Managing multiple vendors or systems also increases administrative workload.

Internal HR and finance teams often spend hours collecting data, verifying reports, and resolving discrepancies. This not only consumes resources but also distracts from more strategic HR activities.

Outsourcing payroll to a global payroll service provider can reduce these costs and free up internal teams to focus on core business functions.

10. Difficulty in Centralised Reporting and Visibility

For multinational companies, having a central view of global payroll data is critical for decision-making. However, when payroll is managed separately in each country, collecting consistent data becomes difficult.

Different file formats, currencies, and reporting structures make consolidation time-consuming. Lack of visibility also makes it hard to detect compliance risks or cost inefficiencies.

A unified global payroll dashboard can solve this by offering real-time insights into salary expenses, tax liabilities, and workforce distribution across countries.

11. Employee Experience and Satisfaction

Timely and accurate payroll builds employee trust. Late or incorrect payments can lead to dissatisfaction and even turnover. For international teams, this issue can be magnified due to delays caused by currency transfers, time zone differences, or miscommunication.

Offering employees access to self-service portals where they can view payslips, update details, and track payments helps build transparency. A smooth payroll experience contributes to overall employee satisfaction and retention.

12. Adapting to Technological Advancements

Payroll technology is evolving rapidly. Companies now use automation and cloud computing to simplify payroll across multiple countries. However, adopting new systems requires investment, training, and adaptation to existing workflows.

Without proper implementation, technology can create confusion rather than efficiency. Businesses must choose platforms that integrate easily, update automatically for compliance, and scale as the organisation grows.

13. Risk of Reputational Damage

Payroll errors, compliance violations, or delayed payments can hurt a company’s reputation. In the age of social media and global reviews, even small mistakes can spread quickly, affecting employer branding.

Moreover, government audits or penalties for tax violations can create negative publicity. Hence, companies must adopt error-free systems and strong internal controls to protect their brand image and maintain employee confidence.

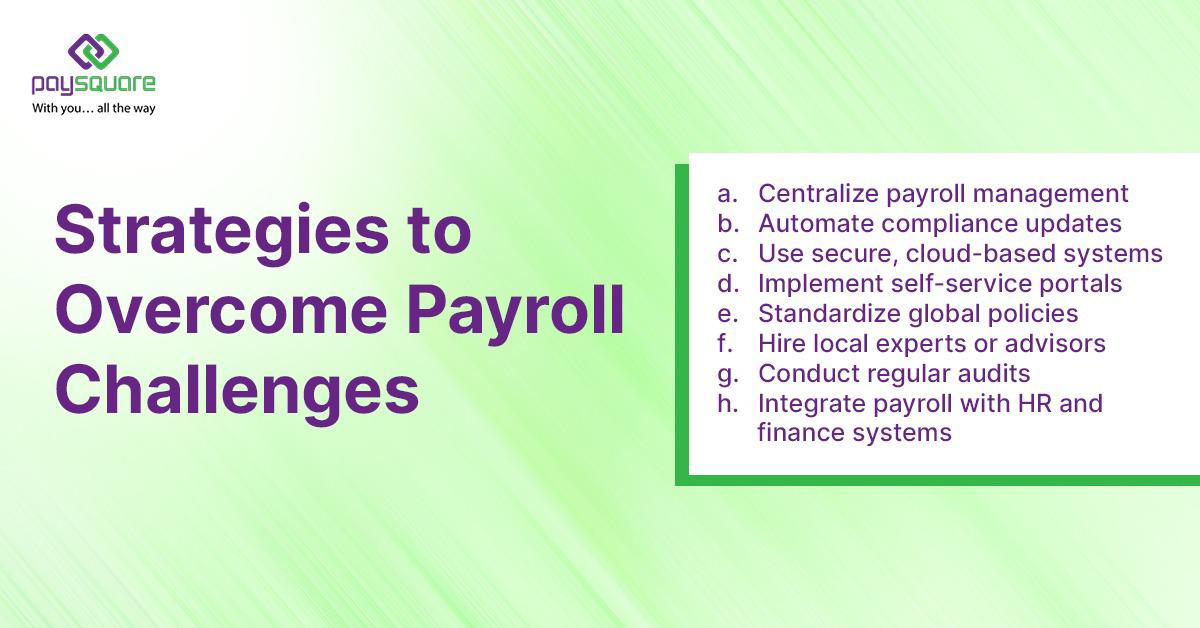

Strategies to Overcome Payroll Challenges

To effectively manage payroll across multiple countries, companies can take the following steps:

- Centralise payroll management with a single global provider or unified platform.

- Automate compliance updates to handle changing tax laws.

- Use secure, cloud-based systems with data encryption and role-based access.

- Implement self-service portals for employee convenience.

- Standardise global policies while allowing for local flexibility.

- Hire local experts or advisors who understand regional regulations.

- Conduct regular audits to identify and fix payroll discrepancies.

- Integrate payroll with HR and finance systems for seamless data flow.

These strategies help businesses save time, reduce errors, and ensure global compliance.

Conclusion

Choosing the right payroll management company can simplify global operations, offering streamlined solutions that reduce administrative burden, improve accuracy, and ensure timely payments across all regions.

By leveraging modern payroll technology, automation, and expert outsourcing partners, businesses can overcome these hurdles efficiently. The goal is to ensure employees across all regions are paid correctly, on time, and in compliance with local laws, while giving organisations full control and visibility over their global payroll.

For companies seeking a trusted partner to manage payroll across borders, Paysquare offers reliable and compliant solutions. With decades of experience and expertise in multi-country outsourcing payroll services, Paysquare ensures smooth, accurate, and secure payroll operations tailored to your business needs.

Discover how Paysquare can simplify your global payroll challenges. Visit https://paysquare.com/.